social security tax limit 2022

The OASDI tax rate. If you collect Social Security early say at 62 and earn income from work that exceeds the income limit Social Security will deduct 1 from your.

However if youre married and file separately youll likely have to pay taxes on your Social Security income.

. 9 rows This amount is known as the maximum taxable earnings and changes each year. If a couple is married each person would have a 147000 limit. There is no limit on the amount of earnings subject to Medicare.

In 2022 the maximum earnings subject to Social Security taxes was 147000. For earnings in 2022 this base is 147000. The OASDI tax rate for wages in 2022 is.

Related

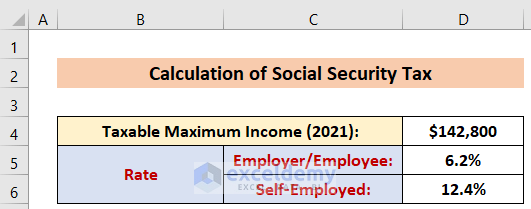

The 2022 limit for joint filers is 32000. For 2022 the maximum wage base jumps to 147000 an increase of 4200 or 29 over the max of 142800 that was in place for 2021. 123 per week 533 per month 6396 per year.

Not everyone knows this but the government doesnt. 1 2022 the maximum earnings subject to the Social Security payroll tax will increase by 4200 to 147000up from the 142800 maximum for 2021 the. The Social Security tax limit is 147000 for 2022 up from 142800 in 2021.

We call this annual limit the contribution and benefit base. In 1937 payroll taxes applied to the first 3000 in earnings. Unlike many other tax cap limits this stands as an individual limit.

In 2022 only the. IRS Tax Tip 2022-22 February 9 2022 A new tax season has arrived. And thats sending the maximum Social Security benefit surging to a record high.

What is the income limit for paying taxes on Social Security. Second you have to pay Social Security payroll taxes on the maximum taxable income in your 35 highest-earning years. Social Security tax limit 2023.

The wage base or earnings limit for the 62 Social Security tax rises every year. Heres the bottom line. Since its inception Social Security has featured a taxable maximum or tax max.

For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000. In 2022 that max was 3345 if you. In 2011 payroll taxes apply to the first.

If that total is more than 32000 then part of their Social Security may be taxable. People who make more than. The Social Security tax limit increased significantly to 160200 in 2023 which could result in a higher tax bill for some taxpayers.

But the government doesnt collect Social Security taxes on all income. What is the 2023 wage limit for FICA tax. That is workers paying into the system are taxed on wages up to this amount typically at the.

The Social Security tax rate remains at 62 percent. The federal government increased the limit for Social Security tax to 160200 up from 147000 in 2022. Updated April 2022 1 2022 Social SecuritySSIMedicare Information.

Hospital Insurance HI also called Medicare Part ANo limit Federal Tax Rate1 Max OASDI Max HI Earnings. The 2022 limit is 147000 up from 142800 in 2021. The resulting maximum Social Security tax for 2022 is 911400.

2022 to 2023. Primary The introduction of a separate Health and Social Care Levy tax in April 2023 has. At a rate of 62 the maximum.

This amount is also commonly referred to as the taxable maximum. Therefore the maximum amount that can be withheld from an employees paycheck in 2022 is. For money earned in 2023 the taxable maximum is 160200 which is nearly a nine percent increase from 2022.

The Social Security portion OASDI is 620 on earnings up to the applicable taxable maximum amount see. The 765 tax rate is the combined rate for Social Security and Medicare. But just as theres a cap on earnings subject to Social Security tax each year theres also a maximum monthly Social Security benefit.

Fica Tax Guide 2022 Payroll Tax Rates Definition Smartasset

Income Limit For Maximum Social Security Tax 2022 Financial Samurai

Overview Of Fica Tax Medicare Social Security

2021 Wage Base Rises For Social Security Payroll Taxes

Social Security Contributions Increased In Spain For 2022

What Is Fica Tax Contribution Rates Examples

Social Diability Lawyer Social Disability Lawyer Blog Fica Taxes For Social Security Disability In 2021

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

5 Social Security Numbers To Know In 2022 The Motley Fool

2023 Social Security Tax Limit

Social Security Taxes 2022 Are Payroll Taxes Changing In 2022 Marca

Social Security Tax Cap 2021 Here S How Much You Will Pay

Proposed Law Impact On Social Security Taxable Wage Base Isdaner Company

The Evolution Of Social Security S Taxable Maximum

2023 Social Security Changes Milwaukee Courier Weekly Newspaper

Increasing Payroll Taxes Would Strengthen Social Security Center On Budget And Policy Priorities

Maximum Social Security Tax 2022 What To Know About Social Security If You Re In Your 60s ह दक ज

2023 Social Security Cola Highest Since 1981

What Is Social Security Tax Definition Exemptions And Example